First Nations Foundation successfully launched the World's First Digital Financial Literacy Training program

First Nations Foundation (FNF) is a national Indigenous non-profit striving for financial wellbeing for Indigenous Australians. It has three main programs: financial literacy education, superannuation outreach and research.

The Challenge

With all strategic pivots and business repositioning there are strengths and challenges. Our journey had a few:

Strengths

Based on 10 years of feedback on our successful in-person Indigenous financial literacy training program, combined with research telling us we needed to lift the scale of our work to reach many more First Nations people if we were going to move our communities from a perennial bottom rung of national financial literacy knowledge, we resolved to pivot to edutech, knowing most of our people have digital devices nationally.

We had a ten-year validated training program with stunning impact 90% of participants having more confidence in managing money, 83% feeling better at managing money, and 70% being more confident about their financial future, confirming research that Indigenous-led products work.

We also had the magnitude, reach and resources of the largest sector in Australia: financial services. Our foundation has been the charity alliance partner for this industry for 6 years so we had positive relationships on our side that we could leverage for scale. We also had government and employers across numerous industries as committed stakeholders. We needed to make this product work for all these stakeholders as well as our Indigenous learners.

We also had sobering research we released in 2019 showing Indigenous people face a financial emergency, all driven by low financial literacy:

- 1 in 2 Indigenous people in severe financial stress

- 9 in 10 lacking any financial security

- 52% of Indigenous people with no savings

- 75% of Indigenous people struggle to access financial services, 25% take up fringe credit, and 38% have no insurance.

“This cannot be transcended without financial literacy, and we are enlisting the help of government and industry to help reach and build a financially-savvy Indigenous population.” First Nations Foundation CEO, Amanda Young, said.

Weaknesses

As a small non-profit, we had to raise the funds for product development and surmount quite a few learning challenges:

- No experience in online delivery and learning management systems

- No experience in adapting successful face to face learning

- Aligning the product and data collection to our Impact Measurement Framework to measure change and continuously improve

- Reducing cost while reaching a greater number of learners

- Appealing to diverse sponsors we would be shifting the cost of delivery to.

The Solution

First Nations Foundation undertook a procurement process with expert advice and selected as our technology partner the education technology leader, Androgogic.

Androgogic was able to cater for all our requirements using Totara Learn and off-the-shelf plugins including their Totara Plus plugin suite. They collaborated with us to adapt our unique business model to a seamless, elegant and positive experience for each type of user. We are able to direct all potential sponsors, employers, organisations and learners to the one website. Each group has a simple and easy to follow pathway to use the site to meet their objectives.

Sponsors are able to register, use their own custom dashboard, choose a sponsorship package, link the package to an employer or organisation and track the progress and success of anonymised learners. Sponsors are logged into a learning management system and its features and functions have a familiar experience such as using a catalogue, a shopping cart and a payment system.

Similarly, employers and organisations are able to register, use their own custom dashboard, assign registration keys and send them to learners via templated emails, post, SMS or telephone. Employers receive automated reports and notifications to track and support the progress of their learners.

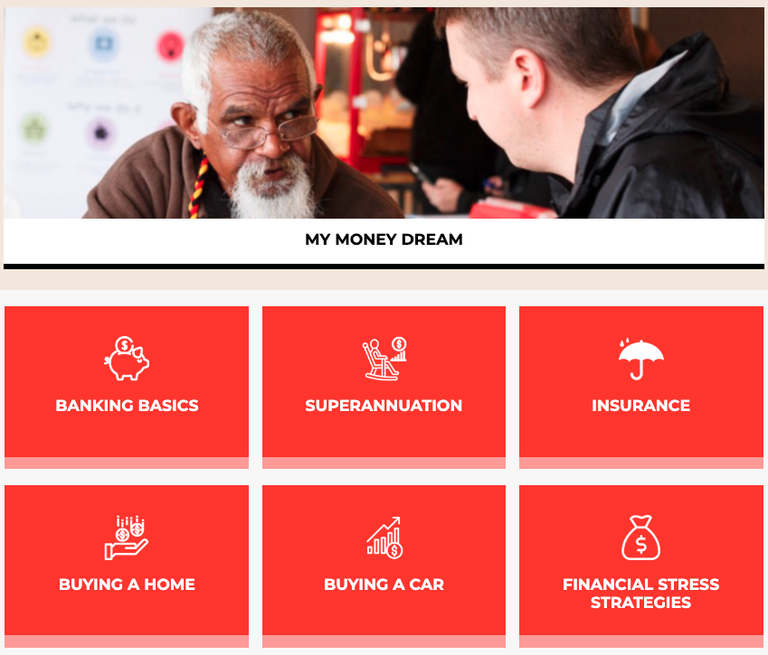

Learners are able to sign-up with their registration key and are immediately immersed in the learning program. On successful completion of the core program learners are guided to elective modules. There are currently six electives, and more are planned.

In addition to providing us with 24/7 support, Androgogic built a custom dashboard for LMS administration tasks that enable us to quickly complete everyday tasks - as a small team this is a huge time saver - while we continue to build on our knowledge of how Totara Learn works. For example, potential learners that signup without a registration code are highlighted in a daily report and easily linked to a sponsor, allocated a registration key, and automatically advised that next time they sign in they can start the program.

We are able to use Totara Learn to collect both quantitative and qualitative data that aligns with and enhances our ongoing research and helps us continuously improve the learning program.

Androgogic also helped us implement our learning design using AndroSCORM to develop mobile friendly content including culturally sensitive and relevant animation, video and graphics using a blend of culture, humour and deep knowledge to create an engaging learning environment.

“Androgogic is proud to be a key partner supporting First Nations Foundation and we were delighted to be able to provide both the Educational Technology infrastructure and courseware development for the My Money Dream project,” said Alexander Roche, CEO/Founder Androgogic, & Principal Educational Technologist.

The implementation of Totara Learn enabled us to have a single environment for sponsors, employers, organisations and learners. We were able to meet our objectives with the assistance of Androgogic and because of the feature rich Totara Learn and Androgogic Totara Plus suite of plugins.

We now have a foundation learning program, technology base and operational processes on which to grow our course offerings and support Australia’s First Nation People.

The Results

First Nations Foundation has successfully launched the world’s first digital financial literacy education program to help First Nations people develop their financial knowledge. We have received queries from around Australia and the world, from South Africa to Canada within the first fortnight of launch.

My Money Dream is more than financial education: it is a behavioural change program for learners, a bridge between Indigenous and financial sectors and a disruptor for how Australia reaches remote communities. The content is carefully aligned to Indigenous values around prosperity and community and using a clever blend of culture, humour and deep knowledge, it is an engaging learning platform. Topics include money and culture, budgeting, banking, superannuation, insurance, loans and credit, buying a home, buying a car and financial first aid.

We know for every person trained, they share learnings with 5.6 more people so the impact of this training, and the data it can generate, is game-changing.

We are at a time where First Nations people have digital access,” FNF Chair and Yorta Yorta man Ian Hamm said. “This Genesis Generation now have the digital tools for Indigenous economic participation. We offer a meaningful way to learn about money which has personal development elements to work within their community expectations, while still achieving personal goals.

Chairperson, First Nations Foundation